The Ultimate Guide to Using Your Smartwatch for Online Stock Trading Platforms Monitoring Investments and Making Informed Decisions

Best Stock Brokers for April 2024

Sam Levine, CFA, CMT, the lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, head of research at StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Blain created the original scoring rubric for StockBrokers.com and oversees all testing and rating methodologies.

For this guide:

- Whenever possible, we used our own brokerage accounts for testing. For several brokers, we used a test account that was provided to us.

- We collected more than three thousand data points (196 per broker).

- We tested each online broker's website, browser-based trading platform (where applicable), downloadable desktop trading platform (where applicable), and of course, the mobile app (or apps in the case of several brokers).

- We met with the product teams of nine online brokers.

To analyze trading platforms for this guide, our writers maintained active, funded online brokerage accounts for testing. In certain circumstances, a demo account was provided by the broker.

StockBrokers.com uses a variety of computing devices to evaluate trading platforms. Our reviews were conducted using the following devices: iPhone 12 Pro, iPhone 15 Pro Max, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro. In testing platforms and apps, our reviewers place actual trades for a variety of instruments.

As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the brokers data to ensure accuracy.

As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Meetings with broker teams also took place throughout the year as new products rolled out. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed.

Once our data collection, auditing, and trading platform testing was completed, we entered our final 1-10 opinion scores of each broker's key areas (Commissions & Fees, Platforms & Tools, Research, Mobile Trading, Education, and Ease of Use). We then ran all the collected data through our proprietary scoring engine to determine each broker's Overall percent score and rating.

Best Trading Platforms in the UK April 2024

Adam is head of content on TradingGuide.co.uk. He has many years of experience in the financial sector and honestly admits that he is in love with his job.

Article was updated: April 13, 2024

Estimated reading time: 23 minutes

Having the best trading platform is one way of increasing your chances of becoming a successful investor in the UK. However, most traders do not know how to choose the right trading platform, which is why we have created this complete comparison of all the top trading platforms in the UK right now. Use the following guide to set yourself up with a platform that suits your specific needs perfectly.

Essence

- Online trading activities are on the rise in the UK, with more individuals participating in various markets due to increased accessibility and interest in investment opportunities.

- Choose an FCA-regulated online trading platform for compliance, user protection, and ensuring a secure trading environment.

- The best online trading platform should feature elements aligning with your needs.

- Always check user opinions and ratings on Google Play, the App Store and Trustpilot before selecting an online trading platform in the UK.

- TradingGuide experts conduct thorough research, guaranteeing credibility and suitability in platform recommendations.

- Trading, especially with leverage, carries inherent risks, so always employ robust strategies for increased successful potential.

- Practice trading using a platforms demo accounts to familiarise yourself with available tools and strategies without risking real funds.

List of the Best Trading Platforms in the UK 2024

- Plus500 Best* CFD** trading platform

- XTB Best commodities trading platform in the UK

- SpreadEx Best spread betting platform in the UK

- FP Markets Best ETF trading platform in the UK

- eToro Best trading platform for beginners in the UK

- AvaTrade Best trading platform for mobile trading in the UK

- Pepperstone Best MetaTrader trading platform in the UK

- FxPro Best Trading Platform With Excellent Support Service in the UK

- OANDA Best UK trading platform with no minimum deposit requirement***

- Interactive Brokers Best trading platform for professional traders

- Forex.com Best forex trading platform in the UK

- Revolut Commission-free trading platforms in the UK

*Investment Trends 2022

**81% of CFD retail accounts lose money on Plus500

***76.6% of retail investor accounts lose money when trading CFDs with OANDA provider

How We Choose Trading Platforms

At TradingGuide, we employ a critical methodology in our trading platform selection process. We begin by conducting thorough research to identify a diverse range of trading platforms available in the market. Our aim is to provide our readers with a comprehensive overview of their options, including both well-established platforms and newer entrants.

Security is paramount in our evaluation criteria. Therefore, we prioritise platforms implementing robust encryption protocols, secure payment gateways, and FCA regulatory compliance. This ensures that our readers can trade with confidence, knowing that their funds and personal information are adequately protected.

Once we have identified potential platforms to recommend, we proceed to a detailed evaluation process. This involves hands-on testing of the platforms functionality, user interface, trading tools, and available assets. We strive to assess each platforms suitability for traders of varying experience levels and trading styles.

To ensure we remain unbiased in this process, we also analyse and sample user ratings and testimonials regarding their experiences with various trading platforms. We get honest opinions on Google Play, the App Store, and Trustpilot, and then combine the findings with our test results. Only those that meet our specifications are listed on our page for our readers.

In this guide

Best Trading Platforms in the UK

Compare The Best Trading Platforms in the UK

Our professional researchers consider various elements for the best online trading platforms to qualify as one of the best in the UK. We assess them based on the following metrics:

Payment & Withdrawal Options

What makes us unique from other researchers is that we also review honest user ratings from the App Store, Google Play, and Trustpilot. We then combine the findings from these two processes for accurate results, as shown in our list below.

General Rating

License

Stock Assets

Forex Assets

Fee on GBP/USD

Minimum deposit

Software

Payment

4.2

FCA, CySEC, ASIC, MAS, FSA

2000+ (CFDs)

60+ (CFDs)

0.00018

$100

Plus500 Webtrader

Bank Wire Transfer, Credit/debit cards, Paypal, Skrill

4.5

FCA, KNF, CNMV

1900

48

from 0.00018 pips

No

xStation 5, xStation Mobile

Credit/debit cards, Bank Transfer, Skrill

4.6

FCA

3,000

60+

from 0.9 pts

No

IPHONE App, IPAD App, ANDROID App, Trading View

Bank Wire Transfer, Credit cards

4.4

CySec, ASIC, CMA, FCA

10,000+

70+

0.0 pips

$100 (72)

MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading App, cTrader, MT5 Mobile Trader

Credit and Debit cards, Bank transfer, BPay, Poli, PayPal, Neteller, Skrill, PayTrust, Ngan Luong, FasaPay, Online Pay, and Broker to Broker

4.2

ASIC, CySec, FCA, FSAS

3000

52

150 PIPs

$50

eToro investing platform, Multi-asset platform, Copy Trader

Debit card, Bank transfer, Neteller, Skrill, eToro Money, Online Banking

4.5

CBI, CySec, ASIC, BVIFSC, FSA, SAFSCA, ADGM, ISA

600+

50+

Free

$100 (72)

MetaTrader 4, MetaTrader 5, WebTrader, Automated Trading, Mac Trading, AvaTradeGO, AvaOptions, Mobile Trading, AvaSocial, DupliTrade, Capitalise.ai

Credit card, Debit card, Wire transfer, Paypal, Skrill, NETELLER, WebMoney

Brief Overview of Our Recommended Trading Platforms Fees and Assets

Choosing the right trading platform in the UK is foundational to successful trading endeavours. Delve into the tables below, outlining crucial details on fees and assets across our recommended trading platforms. By comparing and analysing these insights, tailor your decisions to align precisely with your trading strategies and financial vision.

Fees

| Best Trading Platform | Fees | Minimum Deposit Requirement | Minimum Deposit Requirement | Inactivity |

|---|---|---|---|---|

| Plus500 | From 0.0 pips | 100 | Free | 10 monthly |

| XTB | From 0.1 pips | 0 | Free | 10 monthly |

| SpreadEX | From 0.6 pips | 0 | Free | None |

| FP Markets | From 0.0 pips | 100 | Free | None |

| eToro | 2 pips | 50 | 5 withdrawal | 10 monthly |

| AvaTrade | 0.03 pips | 100 | Free | 50 quarterly |

| Pepperstone | From 0.0 pips | 500 | Free | None |

| FxPro | From 0.0 pips | $100 | Free | $15 once + $5 monthly |

| OANDA | From 0.0 pips | 0 | Free | 10 monthly |

| Interactive Brokers | From $0.01 commission on US stocks | 0 | Free | None |

| Forex.com | From 0.0 pips | 100 | Free | 15 monthly |

| Revolut | Commission from 1% | 0 | Free Withdrawals | 0 |

Assets

1. Plus500 Best CFD Trading Platform*

*illustrative prices

Plus500 is a multi-asset broker that currently offers three platforms: Plus500 CFD with more than 2800 CFD instruments, Plus500 Invest with more than 2700 shares, and Plus500 Futures a futures platform available in the US only. The broker has a simple yet effective interface and a trading platform that was designed in-house, i.e., it uses no third-party software.

Moreover, Plus500 is among the best CFD brokers for mobile trading, with excellent ratings and testimonials from users on Google Play, the App Store, and Trustpilot. You can download and install the trading app on your mobile device in seconds to manage your activities on the go. Naturally, Plus500 also supports desktop trading, and combining desktop and mobile trading will definitely maximise your experience.

To get started with Plus500, a 100 minimum deposit is required. You can make this deposit using various payment methods the broker supports, including Visa, Mastercard, Skrill, and Paypal. Keep in mind that Plus500 is an excellent choice for most traders, even those with a limited budget.

Better yet, as a beginner, you can make use of the Plus500 demo account to test the platform out before you invest real money using the live account. This is advisable since Plus500 has a platform that is slightly different from other platforms that you might be used to.

*Investment Trends 2022

Plus500 Review

TradingGuides Rating:

Educational materials

Regulated in many countries

Pros & Cons

Fees

Trading Assets

Pros

- Innovative software designed in-house

- Great options for deposits and withdrawals

- Reliable and responsive 24/7 support service

- Low spreads for CFD trading services

Cons

- No third-party software or platform offered

- Only provides CFD trading and no spread betting

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Plus500 provides access to 2800+ CFDs across a wide range of different asset classes, including: Indices Country and Sector, Forex, Commodities, Individual shares, ETFs, Options

Note:81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. XTB Best Commodities Trading Platform in the UK

XTB qualifies as the best commodities trading platform in the UK because of its flexibility. While testing the platform, we noticed that it is not only user-friendly and customisable but also features quality resources for research and strategy development. Moreover, XTB doesnt have a minimum deposit requirement, allowing users to get started with any amount they can afford. If you are a new commodity trader, rest assured of quality learning materials, including articles, eBooks, webinars, and more.

XTB lists over 27 commodities, including gold, silver, oil, and more. The assets are available for trading as CFDs with a leverage limit of up to 20:1 for retail traders. Additionally, users have an opportunity to diversify their portfolios using additional 5,000+ instruments, including shares, forex, cryptos, and more. You can test the platforms performance via its demo account for informed decisions.

Its also advisable to study a comprehensive XTB trading review to evaluate if the platform aligns with your specific trading needs.

XTB Review

TradingGuides Rating:

Constantly improving trading platforms

Wide range of global markets

Pros & Cons

Fees

Trading Assets

Pros

- A user-friendly and intuitive design commodities trading platform

- Over 27 commodities listed to explore

- No minimum deposit requirement

- Plenty of learning materials and a virtually funded demo account

Cons

- Only CFD assets offered

- Transaction charges apply to some e-wallet payments

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

The broker boasts a wide selection of tradable assets, consisting of 1500+ instruments, including a range of global markets, such as forex, indices, commodities, ETFs, and others.

3. SpreadEx Best Spread Betting Platform in the UK

SpreadEx is unquestionably the preeminent spread betting platform in the UK, setting the industry standard for traders seeking a seamless and versatile spread betting experience. With a robust history, this broker has consistently delivered a top-notch platform that excels in its simplicity and effectiveness. Moreover, it offers various tradable instruments, from shares and commodities to indices and forex pairs, all underpinned by competitive spreads and a user-friendly interface. Besides spread betting, SpreadEx also allows its users to explore the available assets using the CFD trading method.

SpreadExs intuitive and customisable trading platform empowers traders to tailor their experience to their unique preferences and strategies. Whether youre looking to speculate on market movements or hedge your portfolio, SpreadEx provides a comprehensive suite of tools. These include advanced charting and risk management features on its TradingView platform. Its dedication to providing an accessible yet powerful spread betting platform makes it the undisputed leader in the UK market.

SpreadEx Review

TradingGuides Rating:

Low forex fees

Helpful customer service

Pros & Cons

Fees

Trading Assets

Pros

- The platform offers UK traders an opportunity to spread bet and enjoy the benefits that come with this trading activity

- No minimum deposit requirement

- Hosts over 10,000 tradable securities, including shares, currencies, commodities, indices, and more

- Competitive spreads, starting from 0.6 pips

Cons

- No demo account

- Limited spread betting learning resources compared to what most of its peers offer

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

Currently, there are 60+forex pairs on offer, 17 commodity CFDs and 1000 index and stock CFDs.

4. FP Markets Best ETF Trading Platform in the UK

FP Markets is among the top-rated ETF platforms in the UK, offering investors a wide range of investment options, competitive pricing, and exceptional trading tools. The platform has established itself as one of the best in the industry, and we highly recommend it to UK traders looking to trade ETFs.

With this broker, you will have access to over 290 ETF products, which you can trade on tight spreads, starting from 0.0 pips. You will use the ETF trading method to track shares, commodities, currencies, bonds, and indices trading. Simply put, investors have an opportunity to diversify their ETF portfolios with FP Markets. Moreover, ETF trading allows you to hedge existing investments against downward risks.

Overall, FP Markets is suitable for both beginner and professional ETF traders in the UK. For instance, newbies can enjoy plenty of learning resources, social, and copy trading platforms. Professional ETF traders will explore advanced features on the MT4, MT5, or Iress platforms, thus maximising their potential.

FP Markets Review 2024

TradingGuides Rating:

Low trading fees

Accounts can be opened fast and easy

Pros & Cons

Fees

Trading Assets

Pros

- Has a native app to help you manage your ETF activities using mobile devices

- 290+ ETF products offered

- Low ETF trading fees, starting from 0.0 pips

- Advanced platforms with a superior client portal

Cons

- Social trading is supported on the MT4 and MT5 platforms only

- High minimum balance to use FP Markets Iress account types

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

There are plenty of trading options to choose from on FP Markets. These include 70+ currency pairs, more than 10,000 stocks on global exchanges, 5 cryptocurrency CFDs,46 ETFs, 19 major global indices, and commodities. The commodities available include gold, silver, oil and more.

5. eToro Best Trading Platform for Beginners in the UK

Founded in 2007, eToro is a global broker known to offer more than 2,000 tradable instruments. These include stocks, cryptocurrencies, commodities, indices, and currencies. All you need to do is sign up for a trading or investment account and deposit at least 50 (for UK residents) to get started. However, if you transact via a bank transfer method, eToro requires that you make at least a 500 deposit to access its platform.

We primarily recommend eToro for beginner traders in the UK because of its simple design and easy-to-use platform. The platform is also fully customisable and supported on all devices, making you monitor your trades wherever you may be.

Additionally, eToros platform is known for its impeccable social and copy features. This is perfect for beginners since they will have the opportunity to interact with other investors on a chat group. You can also mirror trades from expert investors via its copy trading feature, thus maximising your experience and increasing your chances of making profits.

Note that eToro supports CFD trading, whereby you get to speculate on an assets price movements to benefit from its price difference. With CFD Trading, you can apply leverage (trade with borrowed funds) up to a maximum of 30:1 for UK investors. The broker also has the Direct Market Access feature that allows you to deal directly with tradable markets order books, making you take total control of your trading activities.

Although eToro does not charge commissions on stocks, its forex charges and spreads are relatively high than what its peers charge. Additionally, there is also a withdrawal fee of 5 and currency conversion charges for withdrawals sent in other currencies besides the USD. That being said, we advise you to confirm your investment capital to decide whether eToro fits your budget.

eToro Review

TradingGuides Rating:

Copy/Social trading

Low minimum to fund an account and begin investing

76% of retail CFD accounts lose money

Pros & Cons

Fees

Trading Assets

Pros

- 0% trading commission on stocks

- Low spreads

- Highly regulated by top-tier authorities, including the FCA

- Fully customisable trading platform with social and copy features

Cons

- Withdrawal charges are high

- Limited educational and research materials

| Types | Fee |

| Minimum Deposit | 50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

- Stocks there is a total of 800 stocks offered ranging from the biggest tech businesses in the U.S. to smaller companies from all over the world. Stock trading is always commission-free with eToro.

- Cryptocurrencies being one of the first brokers to jump on the cryptocurrency bandwagon, it comes as no surprise that eToro dominates this segment. With more than 20 coins and a number of cryptocurrency pairs, there is enough for all crypto traders.

- Currency Pairs in the early days, eToro was just another FX broker and even though theyve developed since, the broker has stayed true to its roots. As a trader, you can choose between 49 currency pairs ranging from majors and minors to a few exotic ones.

- Long-Term Investments unlike many online brokers, eToro is also suitable for long-term investments. For example, their investment portfolios are a great way to diversify your portfolio and limit risk.

- Additional assets in addition to the above, eToro provides access to commodities, indices, and ETFs as CFDs. There is also a range of unique assets such as Crypto Portfolios that are only offered by eToro. This means that you can create a diverse portfolio with ease.

6. AvaTrade Best Trading Platform for Mobile Trading in the UK

Founded in 2006, AvaTrade is one of Europes leading online trading platforms. Based in Ireland, this broker is licensed for operations in the UK as well as the rest of Europe and even in Asia. Besides being licensed and regulated by the Financial Conduct Authority (FCA), AvaTrade also adheres to the stringent regulations of the Central Bank of Ireland (CBI), Cyprus Securities and Exchange Commission (CySEC), etc.

Note that AvaTrade is a CFD broker supporting over 1,500 assets, including forex, stocks, commodities, cryptocurrencies, indices & options. We consider it the best for mobile trading since it features an AvaTradeGO app that is highly rated by users on Google Play, the App Store, and Trustpilot. The broker also hosts third-party platforms like MT4 and MT5 for advanced traders.

Like eToro above, AvaTrade has an award-winning social trading platform (AvaSocial). It also hosts a DupliTrade platform for duplication positions of expert traders with profit potential. However, accessing the DupliTrade platform is rather costly since you need a minimum deposit of 2,000. Furthermore, you must be an active trader to enjoy your experience with AvaTrade since its inactivity fee of 50 kicks in after three consecutive months of non-use.

AvaTrade Review

TradingGuides Rating:

One of the most popular brokers in the UK/EU

Quick deposits and withdrawals

Pros & Cons

Fees

Trading Assets

Pros

- Great selection of platforms that suits everyone

- Features social and copy trading platforms to help make trading easier for you

- Regulated by the Central Bank of Ireland as well as several other trustworthy regulatory bodies like FCA, CySEC, and ASIC

- Zero commissions and low spreads

Cons

- Not the most extensive selection of available assets to choose from

- For some traders, the number of available platforms can make trading inefficient

| Type | Fee |

| Minimum Deposit | 100 |

| Inactivity Fee | USD Account: $50EUR Account: 50GBP Account: 50 |

| Administration Fee | USD Account: $100EUR Account: 100GBP Account: 100 |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

AvaTrade impresses with a robust portfolio of over 1250 assets, encompassing a wide range of trading instruments.

Forex AvaTrade facilitates trading in a broad spectrum of currency pairs, enabling exposure to the dynamic forex market and diverse CFD options.

Stocks and Commodities The platform offers a comprehensive selection of stocks and commodities, allowing users to invest in companies and raw materials across global markets.

Cryptocurrencies AvaTrade supports trading in cryptocurrencies, providing access to a multitude of digital assets, including popular ones like Bitcoin, Ethereum, and more.

ETFs, Bonds, Treasuries, and Indices AvaTrades offerings extend to ETFs, bonds, treasuries, and indices, offering diversification opportunities and exposure to various sectors and industries.

Pepperstone is a world-leading online broker based in Melbourne, Australia. For many years, this broker has also been operating in Europe with licenses from the Financial Conduct Authority (FCA) as well as the Cyprus Securities and Exchange Commission (CySEC). This proves its credibility, and you shouldnt worry about your funds safety.

The broker provides three different third-party platforms that are available on both desktops and smartphones. The platforms are TradingView, Metatrader 4, Metatrader 5 as well as cTrader. And as you maybe already know, all three of these trading platforms are considered among the best in the world. You can also connect the cTrader to TradingView to get the most accurate price information on all available assets.

You can use Pepperstone broker and the trading platforms to trade a range of currency pairs, spread betting, and CFDs, including cryptocurrencies, stocks, commodities, and ETFs. The broker also provides unique currency indices that allow you to trade on baskets of currencies. All you have to do is register for an account and deposit at least 200 to get started.

Pepperstone Review

TradingGuides Rating:

Top tier liquidity

No dealing desk intervention

Pros & Cons

Fees

Trading Assets

Pros

- The MT4 and MT5 platforms give advanced traders an opportunity to explore advanced trading features

- Connect TradingView to your platform for accurate price information

- Fully licensed to offer CFD and forex trading platform in the UK

- Offers social and copy trading

Cons

- No investment opportunities

- Its MT4 platform has basic features

| Type | Fee |

| Minimum Deposit | $200 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

1200+ instruments across FX, indices, cryptocurrencies*, equities, energy and commodities, and more, across three, free powerful platforms.

*Only Pro clients get access to cryptos.

8. FxPro Best Trading Platform With Excellent Support Service in the UK

We find FxPro the best trading platform with excellent support service in the UK for various reasons. For instance, we like the brokers consistent reliability and commitment to customer satisfaction. While other recommended brokers also offer quality support, FxPros team distinguishes itself with unparalleled responsiveness, providing pertinent solutions and diligent follow-ups. This instilled a sense of confidence in our trading activities, knowing that FxPro had our back. However, its worth noting that FxPros customer service is available only on weekdays, potentially inconveniencing daily traders.

From our experience, FxPro has a user-friendly platform that is accessible on MetaTrader 4, MetaTrader 5, cTrader, and FxPro Web. This ensures a seamless trading experience for a diverse range of traders. FxPros extensive list of thousands of securities, with low trading fees and high-quality learning materials, cements its status as a leading trading platform. Nevertheless, its important to highlight that all assets are available solely for CFD trading and spread betting, with no option for outright ownership.

FxPro Review 2024

TradingGuides Rating:

Unique trading tools

Trustworthy broker

Pros & Cons

Fees

Trading Assets

Pros

- 100 minimum deposit requirement

- Low trading fees

- Responsive support service with relevant solutions

- A user-friendly and modern design trading platform

Cons

- Few asset selection compared to its peers

- You can only trade the available assets as CFDs or spread betting

| Type | Fee |

| Minimum deposit | $100 |

| Withdrawal fee | $0 |

| Inactivity fee | $15 once + $5 monthly |

FxPro offers traders a wide range of investment products, including 70 currency pairs, as well as over 2000 different stocks.

9. OANDA Best UK Trading Platform With No Minimum Deposit Requirement

If you are looking for the best trading platform in the UK with no minimum deposit requirement, OANDA is a viable option. Having existed since 1995 and owning an FCA license, you can trust the broker with your personal information and funds. The broker offers a wide range of trading instruments, including CFDs and spread bets on FX, indices, commodities, bonds and metals, as well as advanced trading tools and educational resources. All you have to do is test it via its demo account and deposit any amount you can afford to get started.

OANDA has a user-friendly interface, which makes it easy for traders to navigate the platform and execute trades quickly. Moreover, it hosts adequate trading tools, including technical analysis indicators, economic news calendars, and customisable charts for efficient market research and analysis.

OANDA Review

TradingGuides Rating:

Outstanding research tools

Fast and user-friendly account opening

Risk Warning76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the risk of losing your money.

Pros & Cons

Fees

Trading Assets

Pros

- No minimum deposit requirement

- User-friendly interface

- Advanced trading tools and educational resources

- A virtually funded demo account for gauging your skill level without spending real money

Cons

- Forex, spread betting and CFD assets supported. You can not use OANDA to buy and take full ownership of an asset

- Inactivity fees apply after 12 months of no account activity

| Type | Fee |

| Minimum deposit | $0 |

| Overnight fee | Yes |

| Deposit fee | $0 |

| Withdrawal fee | $0 to your PayPal account* |

| Inactivity fee | Yes |

*We do not charge a fee for withdrawals made to your PayPal account. If your PayPal account is denominated in a currency other than GBP, EUR or USD, you may incur an exchange fee levied by PayPal.

With OANDA, you can trade forex, indices, metals (a wide range of metals, including gold and silver), commodities and bonds.

Note: 76.6% of retail investor accounts lose money when trading CFDs with this provider.

10. Interactive Brokers Best Trading Platform for Day Traders

Interactive Brokers (IBKR) is a pioneer broker that was launched in 1978. Being a US-based broker, its services in the UK are regulated by the Financial Conduct Authority (FCA). You can trust this broker with your investment capital.

What makes IBKR the best trading platform for day traders is its low trading costs. It charges low trading commissions and financing costs. Its margin rates are also low, which encourages day traders to invest more. Interactive Brokers has no minimum deposit requirement when you sign up for a trading account. There is also no deposit fee on this broker. When it comes to withdrawal fees, it only allows one free monthly withdrawal.

IBKR has an easy-to-use fully-fledged trading platform. Its features are perfectly tailored to meet every traders needs, so whether you are a novice or an expert investor, you will never get bored with Interactive Brokers. Additionally, plenty of research tools are accessible on this brokers platform, including charting tools and technical indicators for effective market analysis.

We encourage you to test Interactive Broker platform using its risk-free demo account to see if it complements your trading requirements. In case you encounter any technicalities, its customer support service is available 24 hours a day, five days a week, via phone, email, and live chat.

Interactive Brokers Review

TradingGuides Rating:

One of the oldest broker

Top trading platform for advanced

Pros & Cons

Fees

Payment Pricing

Pros

- Low trading fees

- Plenty of research tools

- Thousands of tradable instruments

- Low margin rates

Cons

- Limited educational resources

- Customer support is available five days a week

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

Interactive Brokers clients can trade stocks, options, futures, forex, cryptocurrencies, bonds, and funds in 150 markets.

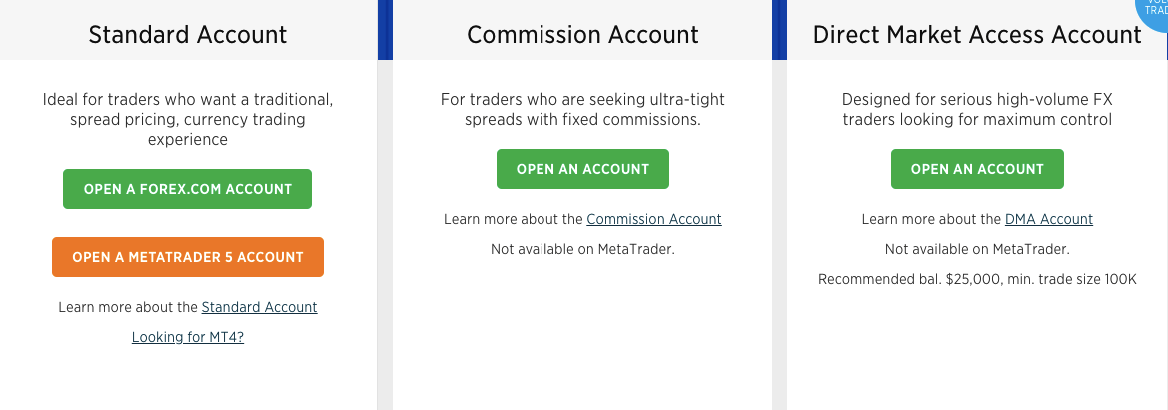

Forex.com is the best forex trading platform in the UK because it is loaded with more than 4,500 tradable instruments, including 80 currency pairs. All forex instruments are on this brokers platform, making it a perfect choice for forex traders.

Forex.com has various trading platforms for all traders. It executes your trades fast and seamlessly, allowing you to be in full control of your trading experience. Its layouts are also highly customisable and robust to suit investors looking for a flexible trading platform.

This forex broker has a minimum deposit requirement of 100 for you to start investing on its platform. You will incur low forex trading charges on Forex.com. It also offers low spreads with no withdrawal costs. On the flip side, the broker charges high fees when you trade stock CFDs. There is also a monthly inactivity fee of $15 should you stop opening positions for up to 12 months.

We highly recommend Forex.com to both novice and expert traders because of its flexibility. You will find a plethora of research and educational tools that will significantly impact your trading experience. Additionally, there is a risk-free demo account that you can use to test and familiarise yourself with how this forex broker works before diving straight in.

Forex.com Review 2024

TradingGuides Rating:

Unparalleled forex service

Wide array of offerings

Pros & Cons

Fees

Trading Assets

Pros

- Low forex trading charges

- Highly regulated by world-class authorities, including the Financial Conduct Authority (FCA)

- +80 currency pairs

- Many educational and research tools

Cons

- Stock CFD charges are high

- A monthly inactivity fee of $15 after one year of inactivity

| Type | Fee |

| Minimum deposit | $100 |

| Inactivity fee | $15 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Overnight fee | $0 |

Clients can trade Forex, Indices, Cryptocurrencies, Stocks, and Commodities (including precious metals and oil) with different account types.

12. Revolut Commission-free Trading Platforms in the UK

Revolut was launched in 2015 as a digital bank to offer money exchange and transfers. It then expanded its services and introduced commission-free stock trading in 2019. Rest assured that Revolut is a trusted broker since it is regulated by tier-one authorities, including the Financial Conduct Authority (FCA).

Opening a trading account on Revolut is straightforward and fast. It does not have a minimum deposit requirement and charges no fees when you trade stocks. The trading charges for commodities and cryptocurrencies are also low making it a good option for traders on a low budget.

Additionally, you will never incur non-trading charges with Revolut, and it offers various modes of payment, including bank transfers, debit/credit cards, and e-wallets.

Like other brokers, Revolut has its drawbacks. It doesnt have a web-based trading platform, and you can only access it through its app. Its tradable instruments are also limited since you can only trade on stocks, commodities, and cryptocurrencies.

Although Revolut does not have a demo account to test it with, we encourage you to give it a try since it doesnt charge commissions on stocks. It is also backed up with a customer support service, which is reachable via phone and in-app live chat.

Revolut Review 2024

TradingGuides Rating:

Commission-free stock trading

Virtual bank account

Pros & Cons

Fees

Trading Assets

Pros

- Access to more than 750 stocks to invest with

- Commission-free stock trading

- Low trading charges

- User-friendly mobile trading platform with great search functions

Cons

- You can only invest in US stocks

- Limited research and educational materials

| Type | Fee |

| Minimum deposit | 0 |

| Withdrawal fee | 0 |

| Deposit fee | up to $4.95 |

| Inactivity fee | 0 |

| Custody fee | 0.12% |

| US stock trading | Low |

| Gold trading | 0.25% markup during market hours 1% markup during non-market |

| Crypto trading | 1.5% markup on bid or ask price |

| Payment Method | Commission |

| UK consumer cards | 1% + 0.20 |

| All International and commercial cards | 2.8% + 0.20 |

| Revolut Pay | 1% + 0.20 |

| Easy Bank Transfer | 1% + 0.20 |

What Do Other Traders Say?

Discovering insights from actual traders is invaluable when considering the ideal trading platform. Below, weve compiled unfiltered user feedback from Google Play, the App Store, and Trustpilot for the top trading platforms in the UK. These diverse perspectives aim to guide your decision-making process for selecting a trading platform that aligns with your trading goals.

1. Plus500

Users commend Plus500 for its user-friendly platform and availability of various trading instruments. However, some users suggest improvements in customer service and educational resources.

After many years of trading on this platform I had the chance to learn and improve my trading skills. Its the best app and easy to use. Ive tried other platforms but this one its far better Ludovic Gyorfi

Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here. ramzyk

What made me happy and relieved in my trading life with plus500 is the withdrawals they so quick it literally never took me more than 6 minutes it was approved. Well guys hope south Africa uses your great platform Sifiso Lucky Biyela

2. XTB

I have shares in other brokers, but Im using this app to check prices and charts because its simply better. Flawless usability Kosciej

Traders appreciate XTBs comprehensive trading tools and educational resources. The platforms analytical tools and customer support are highlighted as advantageous.

I have shares in other brokers, but Im using this app to check prices and charts because its simply better. Flawless usability Kosciej

Very good app. Customer service is welcoming. Lots of information for new traders available for free. Feel very valued and accepted as a beginner. Best app I have found after trying 10+ others. Thomas Ashley

Excellent account managers who keep in touch. Find the app easy to use. Lots of educational content to help me learn. Good use of news and kept up to date with any stock market changes. Ross

3. SpreadEx

SpreadEx stands out for its simplicity and accessibility in trading. Users commend the platforms user-friendly interface and diverse range of markets available for trading.

Easy to use Platform, v friendly staff. Never had any issues Matthew Hill

Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to zero too, much better experience than I have had with CMC for example. TheAceTrader

A very useful financial spread betting app that should cover all your needs. Its definitely the most useable of the broker apps that Ive tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. Theyve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far JakeReadman

4. FP Markets

FP Markets earns praise for its robust trading infrastructure and competitive pricing. Users highlight the platforms reliability and fast execution, which are crucial in trading environments.

Customer support is really marvelous, my problem was taken seriously and solved within no time. Thanks to the team for their efforts. Great! Tariq

The app is user friendly. Even for beginners, it is easy to use, and the customer service live chat is quick in replying. Wayne K

Awesome! Ive been trading with their mobile app for a while now and no issues or lags have occurred; their UI is also clean and smooth. Edwina G

5. eToro

Users praise eToros intuitive social trading platform and ease of use. The platforms copy trading feature and extensive range of tradable assets receive positive feedback.

Good reliable platform for investing in various asset classes and also for day trading. The assigned RMs are proactive and available to give guidance as needed. The RM follows up until the query is resolved. Ankit

Really I think it is amazing app AmirFerdos

6. AvaTrade

AvaTrade receives acclaim for its comprehensive trading options and educational resources. Users value the platforms user-friendly interface and array of available trading instruments.

I was contacted within 10 minutes from opening my account. The account validation process took less than 1 hour. I was literally trading on a live account within 2 hours from opening my account. Very impressed with the service. Mr Coetzee

Very smooth and clean, educational videos to support your understanding of the system and trading in general. Interactive customer service that actively try to support you as best they can, very friendly and understanding Jaundre Koekemoer

Application is easy to use. The customer services is very helpful. And its a great way to learn and trade with professional help alway their to assist Stefan Strydom

7. Pepperstone

Pepperstone receives praise for its efficient trading infrastructure and low-latency execution. Users value the availability of multiple trading platforms and competitive spreads.

Fast and easy deposits and withdrawals, good customer service and a well-regulated broker. Andreas

Ive used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features. Jana from Gold Coast

Easy to open. Easy to use. Easy to add money. Easy to withdraw money. Good customer service. Fast execution. Less spreads. Just learn how to trade and have fun. Pruthviraj Rathod.

8. OANDA

OANDA is appreciated for its platform reliability and range of available markets. However, some users mention the need for additional educational materials focused on trading strategies.

Account was easy to open and was contacted next day by Luke a VERY helpful account manager who was very knowledgeable and answered all my questions quickly. Happy with service. Lucy P T

The most reliable broker out there Ive been with them for years and theyve never disappointed me and when it comes to withdrawal they are super fast I would rate them 10/10 but obviously no broker is perfect but so far so good Zukisa Gaca

iOS 12.3.1 is the software Im currently using and the app crashes out of the blue a lot and Im using the app on my iPad Pro 11 inch with iOS 12.3.1 and on my iPhone XR running the same software! The only way to describe the crash is that it happens out of the blue I could launch the app and it runs fine for a few minutes and then it just crashes and kicks me back to the home screen and then sometimes Ill open the app pull up a chart and try to switch between the different time frames and it will crash! Please fix this I do most of my trades from my mobile devices and I love the oanda app but the random crashes Haagen got to go thanks in advance!!! Michael

9. Interactive Brokers

Traders commend Interactive Brokers for its advanced trading capabilities and extensive market access. However, some users suggest improvements in the platforms user interface for better accessibility.

Out of all of the stock apps that Ive used, this one is by far the best. Better interface, easier to trade, faster to research, easier to compare, best output for reports, etc. TD Ameritrade was purchased by Schwab, and I hope Schwab has the good sense to keep this app available to their customers. Otherwise I will be looking for a new brokerage. Brian Hoffman

They have a great platform for new and advanced traders . Their customer service is great , very helper, and quick to respond. There are a lot of tools at ur fingertips to inform and educate. Brad Fountain

10. Forex.com

Users appreciate Forex.coms trading platform and comprehensive research tools. However, some users mention the need for improved customer service and educational resources.

Its a very good app. Easy to use and execution is fast. I enjoy using it. Charles Salter

I dont understand why i cant get notifications, whether its alerts or trades or news, i cant get a notification. Ive uninstalled and reinstalled but still nothing. I get a pop up in the app to allow notifications but then once im in system settings theres no option to allow notifications. I dont know what to do about it so here i am. Hopefully this gets fixed ASAP. NotifyM3Forex

A Great Broker for Noobs and Pros! Customer Service is great they help with any problems you may be having. Website is easy to navigate as well. Caden Reimers

11. Revolut

Revolut is recognized for its user-friendly interface and access to various markets. However, there are occasional remarks about the need for more advanced trading tools and features.

Revolut ease of use, easy payment to other members is great. Visibility of all transactions as far back as you wish is also great. Receiving money and messaging option is convenient and easy. Other options for investments though I dont use much are also properly presented. Overall great App. Lino Busuttil

After years of using it, Revolut is still going strong. I love the recent app upgrade, much more intuitive and well thought out. Not travelling abroad without it, just setting default payment in Wallet to Revolut card the moment I cross the border. Michal T

Read about the best Bitcoin trading platform in our other article.

Other Trading Platforms Tested

The UK financial market is dominated by hundreds of trading platforms that are secured and regulated by top-tier authorities such as the FCA. Our recommendations above will help you get started on a good note. You simply have to compare their features to ensure you select the best one for your trading needs.

That being said, below are other platforms we tested that you should also consider trading or investing with in 2024.

- DeGiro Best trading platform for everyday investors with no minimum deposit requirement

- Saxo Best trading platform in the UK with a vast stock selection

- XM Best cryptocurrency trading platform

Is Online Trading Legal in the UK

Online trading is a global activity that has enabled many individuals to boost their income. It is legal in the UK for as long as you adhere to the countrys trading regulations. For instance, you must be a UK resident above 18 years to trade. You should also have an income for a broker to accept you as a trader.

Remember, while there are plenty of legit brokers, some of them are fraudsters looking for naive traders to scam. Therefore, always ensure you select a broker that is licensed and regulated by the Financial Conduct Authority (FCA). FCA-regulated brokers allow you to trade legally, meaning you can easily take legal actions against them in case of an agreement breach.

How to Choose the Right Trading Platform in the UK

If you want to increase your chances of becoming a successful investor in the UK, you need to choose a reliable broker with a trading platform that aligns with your trading needs, ie. it has to be one of the best online trading platforms in the UK. The platform should also work seamlessly on all devices, which gives you the flexibility to keep track of your trades even while on the move.

The following are factors to put into consideration when choosing the right trading platform. We hope that it helps you choose the right broker and kickstart your trading venture.

Its a no-brainer that trading in the UK is legal only if you invest with a broker that is licensed and regulated by world-class authorities. Therefore, make sure that the trading platform you are using is under a broker that holds licenses from tier-one authorities. Most of our recommended brokers have multiple licenses, which makes them even more credible to offer their services to UK clients.

The best trading platform for you should offer trading charges that you can afford to make your trading experience worthwhile. We advise you to first go through a brokers trading charges before creating a trading account. Check the commissions, spreads, non-trading charges, financing costs, inactivity fees, and more to see if it is worth your commitment.

You should not randomly choose one of the day trading platforms in the UK that we have listed without first confirming what markets you can invest in. You will find some brokers with a wide range of offerings while others have limited. Therefore, depending on your requirements, choose a broker with a trading platform that will make your experience worthwhile.

If you have read our recommended brokers mini-reviews above, you probably have noticed that some of them are still offering traditional payment methods, including debit/credit cards and bank transfers. If you prefer using e-wallets like Neteller, PayPal, and Skrill, we advise you to find a UK trading platform that supports such payment methods.

Finding a trading platform with reliable and responsive customer support is essential for your trading experience. Even though most of our recommended brokers are not available every day, we assure you that they are responsive when contacted during the days that they are available. Therefore, if you are a frequent investor, it is wise to find a trading platform with customer support that is available 24 hours, every day.

A broker with a demo account gets a plus point since it allows you to test it without investing a single pound. However, a few brokers do not offer demo accounts. You will notice that these brokers mostly do not have a minimum deposit requirement or have low trading charges, which means that you will spend a small amount of your capital testing them.

Find out more about the trading options in the UK in our other guide.

Do You Prefer a Desktop or Mobile Trading Platform?

When looking for the best trading platform for your specific needs, there is one factor that is more important to consider than all the others. The only exception is safety which you should always prioritize.

The factor that were talking about is how and where youre planning to trade. This is because there are both desktop and mobile platforms, and even though most brokers offer both versions, they are not created equally.

As you probably guessed, a desktop platform is best for your main trading station, preferably located in your home. A mobile trading platform, on the other hand, is best for when youre out and about and if you want to keep track of your open positions or assets that you are analyzing.

With that said, you can find the main advantages and disadvantages of both types of platforms below. And please keep in mind that the best solution is to use a combination of both mobile and computer software. Also, by signing up to a broker, you will gain access to both a mobile and a desktop version, that way you dont need several accounts to use different platforms.

Pros and Cons of Desktop Trading

In our opinion, everyone needs to have access to a desktop or laptop in order to trade properly. Every professional day trader in the world does most of their trading on a computer, and should do the same.

The benefits to using a desktop UK trading platform is mainly screen size and performance. By trading on a computer (with or without an extra screen) you can create a trading station where you can easily analyze assets, review graphs, and get into detail about the data surrounding the assets youre trading.

Similarly, desktops are still better than most smartphones meaning you can run more programs and tools at the same time, making your analytic work more efficient.

Another great benefit with a desktop platform is that you can place it in an office or another place where you only trade. That way, trading will feel more like a job and you will find it easier to be efficient when stationed in front of your computer.

Pros and Cons of Mobile Trading

Mobile trading has grown substantially in the last few years and for many online brokers, the majority of transactions done on their platforms are done using a smartphone. Because of this, we think that everyone should have access to a mobile platform as well as a desktop.

The main benefit of mobile trading platforms is that they allow you to keep track of the financial markets while youre out and about. That way you can open and close new positions when needed as well as continue your analytic progress even when you leave your computer.

In turn, this will result in you having many more opportunities to invest and will, in many ways, improve your chances of making a profit. Never miss another profitable trade or miss closing a position with a mobile trading platform.

Read more about Best Trading Apps UK 2024 in our other guide.

Please note: this section was not written to help you choose between desktop or mobile platforms. Instead, or intention was to help you understand that the best solution is to use both versions together.

How You Register an Account with a Trading Platform in the UK

By now, you have insight into what to expect from the best trading platforms in the UK. Therefore, the only thing left to show you is how you register an account with the top trading platforms.

Since all online brokers that we recommend are regulated by the FCA, they are obligated to follow the same regulations and Know Your Customer (KYC) methods. Therefore, the process and the following steps can be used to register an account with any trading platform on the UK market.

The first step is to find the trading platform that you want to use and a broker that provides it. For your own sake, we suggest that you follow our recommendations in the sections above.

Then, you follow the links provided by us to visit the brokers registration page. You can register an account using either your smartphone or computer and after youve registered you can seamlessly switch between the two devices using the same trading account.

Similar to registering an online bank account or any other type of online service account, you initiate the registration by providing basic personal information. This includes your full name, date of birth, address, phone number, and email address.

To be approved for a trading platform, brokers will also ask you to provide details about your income and your level of trading-related knowledge. All of this is done to help protect you.

According to Financial Conduct Authority (FCA) regulation, you also have to verify your identity before you can deposit funds and start trading online.

To do this, you need to submit two documents: a copy of your ID to prove your identity and a recent utility bill or bank statement to prove your residence. Once this information has been submitted, it will be manually verified by the broker before your account is activated and you gain access to your trading platform.

Please note that most brokers allow you to open a demo account without completing the verification process. This way you can test said trading platform out before you commit to using it.

Once your identity has been verified, you need to make an initial deposit to complete the process. This is the very last step needed before you can start using a trading platform in the UK.

All brokers have a minimum deposit level that you have to reach. This can vary from 0 to several hundred pounds so please ensure that you pick one that you can afford to use.

Investing vs Trading

Trading and Investing are two approaches to participating in the financial markets. Although they share a few similarities, they differ when it comes to underlying principles and time horizons. Note that investing is the buying and holding of a financial asset such as stocks for an extended period with the aim of generating a return on investment. Here, investors focus on the long-term potential of an asset and consider factors such as fundamental analysis, company financials, and industry trends before making a purchase decision.

Investors tend to take a more passive approach to investing, relying on the performance of the asset over time rather than actively managing their portfolio. Investment strategies can include diversification, dollar-cost averaging, and buy-and-hold.

In contrast, trading involves the buying and selling of financial assets over shorter time to take advantage of short-term price movements. Traders focus on technical analysis, market trends, and more to identify short-term trading opportunities. They use various trading strategies, such as day trading, swing trading, position trading, and more, to profit from these price movements.

Trading requires a more hands-on approach, whereby traders must regularly monitor their positions and adjust their strategies based on market conditions. Overall, understanding the difference between trading and investing is essential in deciding the best approach when looking to put your money into the financial market.

FAQs

How do I start investing?

The first step towards investing in the financial markets is learning how they work and identifying areas you are good at. Then, confirm your investment capital before choosing a broker that aligns with your trading requirements. Note that online brokers have varying features, and therefore we advise you to keep a critical eye when deciding which broker is best to trade with.

After making your choice, create a risk-free demo account to practice and learn more about the financial markets until you are ready to make the first real investment. You can now sign up for a live trading account and make your deposit depending on the brokers requirements. At this point, the broker will allow access to various market assets where you can start investing and have a shot at making profits.

How much money do you need to be a day trader in the UK?

You can start day trading with as little as 10. This is because many brokers in the UK do not have a minimum deposit requirement and their trading charges are also low. However, investing more considerable funds like 500 and above puts you in a fortunate position to earn more profits. That being said, brokers understand that each trader has their own budget, and it is crucial to stick to it to avoid spending more. So, all you need to do is choose a broker whose charges align with your budget to have the best trading experience.

Is day trading illegal in the UK?

No. Day trading in the UK is legal, and many traders are embracing the activity because of the quick profits it brings*. However, you must trade using a licensed and regulated broker by the Financial Conduct Authority (FCA). Such brokers are safe and allow you to enjoy trading under the best conditions. In addition, get a complete understanding of how day trading works, and remember to always have a budget. For newbies willing to try day trading, note that various brokers host demo accounts, so sign up for one on your preferred broker and practice day trading before investing real money. Good examples of day trading brokers in the UK are recommended in our mini-reviews above.

*Remember, your capital is at risk.

Can I learn the stock market for free?

Yes. Most of our recommended brokers above offer free educational materials, including free lessons on the stock markets to improve your trading experience. As a newbie, start by learning the basics and understand how the stock market works. In addition, take advantage of stock brokers demo accounts to practice what you have learned until you are confident in creating a live account. Do not rush to invest a lot of money in stocks unless you are convinced with your market analysis. The good news is that many stockbrokers will allow you to purchase a fraction of a share, which is an excellent opportunity to try how your first investment turns out to be before going all in.

Which trading platform is best for beginners in the UK?

Based on our extensive research and many tests, we think that eToro is the best broker for beginners in the UK. This is because it offers a clean and simple interface with several sophisticated tools for beginners, such as the groundbreaking copy trading feature. There is also a social platform where beginners and professionals can share tips and experiences.

The only downside with eToro for beginners is that its quite an expensive broker with high fees, especially if you want to make use of the copy features. Therefore, ensure that you have a suitable budget before you get started.

What is the best free trading platform in the UK?

None of the best day trading platforms in the UK are completely free, at least not if you want to make profits in real money. Registering a trading account is free, however, trading always comes with certain fees. When using an online trading platform, you will most likely pay spread for each trade, and if you invest long-term, you pay commissions for each investment.

As mentioned, its free to sign up with brokers, although most of them have a minimum deposit requirement that you have to meet in order to activate your account. But there are exceptions, such as CMC Market that have no minimum requirement. So, in case you want to trade as cheap as possible, try finding a broker with low fees and conditions.

In addition, most top brokers offer demo accounts which are replicas of real trading accounts. These accounts are technically free to use but since you trade with virtual funds, you will never make any real profit.

What is the best platform for day trading in the UK?

Interactive Brokers is, by far, one of the best brokers for day trading, whether you reside in the UK, EU, or the United States. This is a broker made by professionals, for professionals, and it caters to day traders that have high expectations of the tools and brokers they use.

If your ambition is to start trading professionally like a day trader, you ought to pick a broker suitable for that already when you get started. And since IBRK can be used by beginners and day traders alike, its an excellent option. Alternatively, follow our guidelines above in choosing the best trading platform based on your day trading requirements.

Which platform is best for trading?

It depends on what assets and markets youre trading and which broker you want to use. Some brokers have developed their own platforms, such as Plus500, and it is absolutely amazing for CFD trading. Then there are third-party platforms used by several brokers that are also some of the best in the world. For example, MetaTrader 4 is the uncrowned king of forex trading platforms, offered by a substantial part of all top-tier brokers in the UK.

Overall, the best platform for trading is the one suitable for your trading needs. The good news is that we have recommended the best above that have been tested, compared with others, and approved by our expert researchers.

What is the safest trading platform?

The safest platform is always a regulated and encrypted trading platform offered by a licensed and regulated broker. We only recommend and review brokers regulated by the Financial Conduct Authority (FCA) meaning every platform mentioned on this website is one of the safest.

In fact, since all brokers operate under the same regulation and many of them offer the same platforms, the safest trading platform is anyone that you find here. Trading with unregulated brokers in the UK is illegal and unsafe for you. Remember that some brokers are only in the market to defraud you of your hard-earned money, so be careful.

Conclusion

We have seen many traders lose their hard-earned money to brokers simply because they did not choose the right trading platforms for their investment requirements. We hope that our recommended UK trading platforms will act as guidance in starting your trading venture. If you combine the right broker with good trading strategies, you are unstoppable to becoming an independent and successful investor.

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that were comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

Adam Jarfjord

is our leading content maker and head of the content department. For Adam, trading is not only a job but also a passion for more than 5 years. He has many years of experience in the financial sector and honestly admits that he is in love with his job.